Growth in a productivity slump

Adjusting to the higher cost environment | FY2021-22 | Edition #4

Earlytrade data indicates productivity will slump, as the cost of operations and growth rise

Leaders must navigate higher costs, more concentrated supply chains, and a national skills crisis

Strategies for growth to encompass whole-of-supply-chain thinking, productivity-focused innovation, and supplier collaboration

Executive Summary

As the Earlytrade liquidity marketplace has grown, so too has the richness of insight we can extract from the 1.6 million business-to-business invoices we track between 80,000 buyers and suppliers each year.

Over the next six to 12 months, we see productivity slumping under the weight of higher costs, a higher concentration of supply chain activity towards medium and large suppliers, and the unfolding national skills crisis.

For leaders, simply maintaining a business’ current pace of operations is becoming an incremental investment decision.

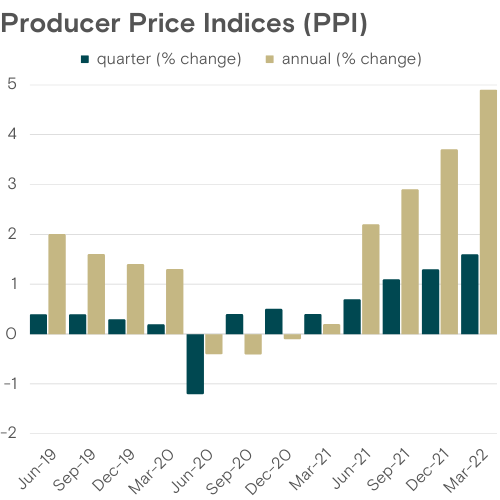

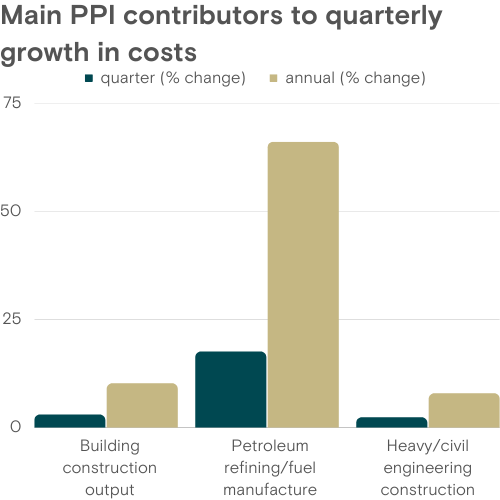

As the nation emerged from lockdowns, we watched prices jump upstream (Producer Price Indices, 4.9%) and downstream (Consumer Price Index, 5.1%), putting the cost of growth out of reach for many.

Doing more with less is now an imperative.

Alarmingly, new research released by the ABS shows that nearly half of Australia’s businesses had already pulled resources away from innovation activities to bolster core business operations during the pandemic.

The further that decision makers allow their businesses to recede from productivity-driving innovation, the more burdensome the cost to grow will become.

Doing more with less is now an imperative.

Naturally, this report offers a particular focus on the construction and infrastructure sector where Earlytrade spends a lot of time consulting with leaders in the industry, and where these factors are being felt more severely.

The latest productivity data for construction shows -0.7% growth for 2019-20, which was underpinned by deteriorations in almost all contributing factors: labour, energy, and materials. To state the obvious, these inputs have only deteriorated throughout 2021-22.

Right now, business leaders need to be asking their teams for innovative thinking and winning strategies to drive productivity at the many points of production in corporate supply chains.

To help narrow the focus, we’ve leveraged Earlytrade’s proprietary marketplace data and official statistics to scope three trends that capture a degree of certainty in an uncertain market:

New cost of business, and growth

Skills crisis bottlenecking supply chains

A growing pool of ESG capital

Our analysis focuses on liquidity as the lifeblood of businesses and as a barometer for stress and growth in supply chains.

We believe supplier access to fair and affordable liquidity is an antidote to many supply-side problems faced by corporates today.

Whether cost trends continue upwards or have peaked, we should view them as baked-in. They are not going back down and holding our breath until it is all over isn’t a viable strategy.

So, how do you grow and how do you win in this higher cost environment?

- Guy Saxelby, CEO & Co-founder at Earlytrade

EARLYTRADE SUPPLY CHAIN SCORECARD FY2021-22

Productivity to slump under higher costs and skills crisis

Earlytrade’s Supply Chain Scorecard tracks 1.6 million B2B invoices representing nearly $10 billion of trade between 80,000 suppliers and some of Australia’s largest corporate buyers.

Current pace near impossible, growth targets drifting

Productivity will slump over the next six to 12 months as the higher cost environment makes it nearly impossible to maintain the pace of current operations, and growth targets are put beyond reach for many firms.

In 2020-21, Gross Value Added per hour in the private sector slowed (1.2%), eroded by declining access to capital, the tightening labour market, higher energy costs, and cost inflation on materials and services.

Earlytrade’s Supply Chain Scorecard, tracking 1.6 million B2B invoices, provides a real-time view of how these inputs have changed throughout 2021-22 and how they will shape the outlook.

Beyond FY22, the overwhelming consensus is an upward trajectory on the March Producer Price Indices (PPI, 4.9%) and Consumer Price Index (CPI, 5.1%).

As B2B costs continue to climb, corporate buyers’ spend has become more concentrated towards medium and large suppliers to the disadvantage of small businesses, as the average Buyer Spend by Supplier increased 10% YoY.

The proportional drop in revenue for small suppliers from corporate buyers, compounds the effects of inequitable access to traditional finance. In the lead up to the pandemic, many small businesses paid in excess of 700bps interest to access capital from traditional lenders. This is an improvement of only 18% from 2019 through the pandemic, while large firms saw their cost of capital drop 43%.

In the wake of the pandemic and lingering global supply disruptions, many corporates have seen local and small suppliers, which make up more than 90% of corporate supply chains, as critical to sustainability and ESG success, providing them with greater control and flexibility on invoice payments.

Total Value of Trade between buyers and suppliers on Earlytrade increased 46% across the financial year. As this pool of liquidity available for early payments increased so too did the proportion that was accelerated by suppliers, with the Early Payment Ratio jumping 49%.

This has been crucial to supporting productivity in supply chains as businesses transitioned out of lockdowns, and away from the associated fiscal stimulus, into the higher cost environment.

The rate on early payments through Earlytrade broadly tracked the change in the cash rate, both increasing 8 bps, supporting eligible suppliers with access to affordable liquidity, and a simple means to shorten cash conversion cycles.

Consequently, new Supplier Registrations increased 24% YoY, and Early Payment Demand more than doubled as suppliers across sectors accelerated payments to avoid debt-based lending and to support business growth.

In the higher cost environment, corporates will need to collaborate with their supply chains to ensure sufficient liquidity is available to navigate the overlapping crises across gas and energy prices, the tightest labour market in 40 years, and on-going supply disruptions fuelled by severe weather events, the Russia-Ukraine war and China’s zero COVID policy.

A SHARPER FOCUS

Data-driven trends in uncertain times

New cost of business, and growth

Is the cost of growth now beyond reach? Regardless of whether inflation has peaked or will continue to climb, costs are higher and will not return to pre-pandemic levels.

Given the pandemic had already forced nearly half of Australian businesses to pull resources from innovation activities to bolster core operations, the journey back to higher productivity and growth only gets more expensive.

Skills crisis bottlenecking supply chains

40-year low unemployment is a skills crisis. ABS data from June shows the most significant factor preventing more than 400,000 vacancies from being filled is a lack of applicants with adequate skills and experience.

The outlook is bleak for businesses needing higher skilled employees to drive growth initiatives.

Growing pool of ESG capital

Better together to unlock Scope 3 value. Sustainability-linked loans now make-up a quarter of the total loan volume in Australia, equating to around $7 billion in the first quarter of 2022, according to ANZ.

Although regulation in Australia is lagging, the SEC in the United States released draft rules in March which would require firms to report Scope 3 emissions, covering suppliers’ carbon footprints.

This will have implications for Australian firms with US compliance exposure, even before domestic regulation catches up.

Winning strategies for growth

Adjusting to the high cost environment, low productivity environment

Ask us about…

Big ideas: Industry-wide liquidity markets

Fighting inflation: Delivering complex infrastructure and other projects sustainably

Net zero supply chains: How to motivate and empower suppliers to report

Value and returns: Build a customised business case